Newsletter 1/2021

Business overview

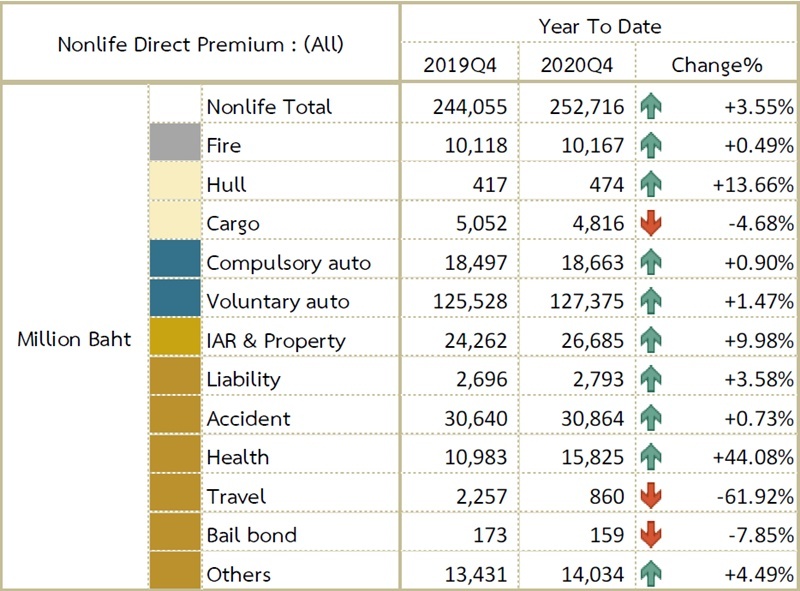

In accordance with the statistics of the Office of Insurance Commission (OIC), the total non-life insurance premiums from January to December 2020 amounted to 252,716 MB, or 3.6% growth, premium details by type of policies as Figure 1.

Source: OIC, Summary of General Insurance Business Q4/2020

Figure 1 General insurance premiums by type of policies

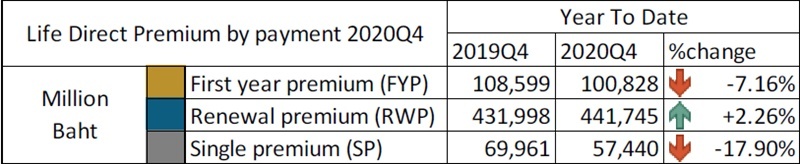

Life insurance premiums from January to December 2020 amounted to 600,013 MB as 100,828 MB from the first year premium, 441,745 MB from the renewal premium and 57,440 MB from single premium contracts. Premium details by payment as Figure 2.

Source: OIC, Summary of Life Insurance Business Q4/2020

Figure 2 Premium details by payment types

For the first quarter of 2021, the Group still kept improving the online sales channels to support insurance sales to support new Covid-19 insurance sales and the renewals Virus found, Get Paid product as well as other products relating to Covid-19 virus outbreak along with other Health insurance, Fire insurance and Freelance insurance products, etc., the Group sold after the outbreak last year, including the new launched products in the quarter i.e. Fair car insurance, Low risk low pay insurance, White car insurance, Low usage car insurance helping customers to reduce expenses from unexpected incidents. Also, the Group well controlled costs and utilized resources effectively, resulting in the continuation of great performances as follows:

Company Overview

| Description | 2020 | 2019 | YoY | |||

|---|---|---|---|---|---|---|

| MB | % | MB | % | MB | % | |

| Service income | 828.8 | 98.0 | 814.1 | 98.9 | 14.7 | 1.8 |

| Other income | 16.8 | 2.0 | 9.0 | 1.1 | 7.8 | 86.9 |

| Service costs & expenses | 401.8 | 47.5 | 407.4 | 49.5 | (5.6) | (1.4) |

| Gross profit | 427.0 | 51.5 | 51.5 | 50.0 | 20.3 | 5.0 |

| Administrative expenses | 189.6 | 22.4 | 191.3 | 23.2 | (1.6) | (0.8) |

| Net profit | 201.7 | 23.8 | 179.3 | 21.8 | 22.3 | 12.4 |

| Earnings per share (Baht) | 0.67 | 0.60 | 0.07 | 11.7 | ||

- Service income is 828.8 MB compared to 814.1 MB of Q1/2020, increased amounted to 14.7 MB or 1.8% from the increase of sales and services.

- Service cost and expenses is 401.8 MB or 47.5% of total revenues compared to 407.4 MB or 49.5% of Q1/2020, a decrease amounted to 5.6 MB or 1.4% from effective service costs control.

- The gross margin is 427.0 MB or 51.5% compared to 406.7 MB or 50.0% of Q1/2020, an increase amounted to 20.3MB or 5.0% from the additional online channel.

- Administrative expenses is 189.6 MB or 22.4% compared to 191.3 MB or 23.2% of Q1/2020, a decrease amounted to 1.6 MB or 0.8% from effective cost controls and resources management by using pre-invested technologies to support the increase of faultless works.

- The net profit of the group for the operation results of Q1/2021 is 201.7 MB or 23.8% compared to the net profit amounted to 179.3 MB or 21.8% of Q1/2020, an increase amounted to 22.3 MB or 12.4% from the increases of sales of every channel as well as effect cost controls by leveraging on-hand technologies.

- Earnings per share is 0.67 baht per share compared to 0.60 baht per share of Q1/2020, an increase amounted to 0.07 baht per share or 11.7%

Investor Relations Department

Tel. 02 119 8888 ext.5009